Want to learn crypto trading without risking real money

In this guide, you'll discover exactly how to paper trade crypto using a professional trading simulator. This is a beginner guide for crypto that shows how to master crypto trading with a crypto trading simulator and crypto demo account, so you can practice crypto trading without money and improve with feedback. This guide walks you through setting up your first paper trade using Mock Trade, tracking your performance, and using gamification to accelerate your learning-all with zero financial risk.

Whether you're searching for a crypto trading simulator, crypto demo account, or simply want to practice crypto trading safely, this complete guide covers everything from your first virtual trade to knowing when you're ready for real money.

By the end, you'll have a clear path to build trading confidence with $50,000 in virtual USDT and AI-powered feedback on your completed trades.

TL;DR

- Paper trading lets you practice with virtual funds using real-time crypto prices.

- Use position size + stop-loss distance to control risk per trade.

- Track results with a journal, performance metrics, and AI feedback.

- Most beginners should practice 1-3 months before risking real money.

- Keep paper trading alongside small real trades once you're ready.

Table of Contents (click to expand)

Quick links to jump to any section of the guide.

- Best Crypto Paper Trading Apps (Comparison)

- What Is Crypto Paper Trading

- How to Start Paper Trading Crypto (Step-by-Step)

- Step 1: Create Your Free Account

- Step 2: Navigate to Mock Trade

- Step 3: Place Your First Mock Trade

- Step 4: Track Your Trade Performance

- Step 5: Review AI Feedback

- Beginner First 7 Days Plan

- Understanding the Mock Trade Interface

- Complementary Features: Portfolio and Watchlist

- Gamification: Leagues, Tasks, and Achievements

- Trading Principles and AI Feedback

- Developing Your Paper Trading Strategy

- When to Transition from Paper to Real Trading

- Frequently Asked Questions (FAQ)

- Conclusion: Start Paper Trading Today

Best Crypto Paper Trading Apps (Comparison)

An at-a-glance overview of popular options and who they suit.

This is a neutral overview of common options people use. The right choice depends on what you want to practice (spot vs. derivatives, manual vs. automated, mobile vs. desktop).

Quick comparison

- All-in-one simulator: Coinrithm. Best for structured learning with paper trades, portfolio tracking, tasks, and feedback in one place.

- TradingView paper trading: Best for chart-first traders who want to place simulated orders directly on advanced charts.

- Exchange testnets: Great for learning exchange-specific order flows and fees in a sandbox environment.

- Binance Mock Trade: Useful if you plan to trade on Binance and want to practice with their interface.

- eToro virtual portfolio: Good for beginners who want a simple, social-trading style experience.

How to choose

- If you want education + tracking, use a learning-focused simulator.

- If you want chart practice, use a charting simulator like TradingView.

- If you want platform familiarity, use that exchange's testnet or demo trading mode.

Why not just use CoinGecko or CoinMarketCap?

CoinGecko and CoinMarketCap are excellent for market data, price tracking, and crypto research—and they dominate the space with massive traffic. However, they're data aggregators, not practice platforms.

What they offer:

- Real-time prices and charts

- Portfolio tracking (manual input)

- Market cap rankings and coin data

What they lack:

- No paper trading execution – You can't place practice trades or test strategies

- No active learning feedback – No AI analysis of your trading decisions

- No gamification – No leagues, tasks, or progression tracking to build trading habits

- No risk management practice – No stop-loss, limit order, or position sizing execution

The gap: If you're currently using CoinGecko or CoinMarketCap to track prices but want to actually practice executing trades, managing risk, and testing strategies, you need a dedicated paper trading platform like Coinrithm that combines real-time data with active execution and AI-powered learning feedback.

Bottom line: Use CoinGecko/CoinMarketCap for research and price alerts. Use Coinrithm when you're ready to practice actual trading mechanics, build muscle memory, and get feedback on your decisions—all before risking real money.

What Is Crypto Paper Trading

Clear definition and why it matters before you risk real money.

Crypto paper trading is the practice of trading cryptocurrencies with virtual funds to test strategies and learn market dynamics without financial risk.

You get real-time market data and actual cryptocurrency prices—typically starting with $50,000 USDT in virtual balance.

Think of it as a flight simulator for crypto traders—practice with real conditions without real-world stakes.

Paper Trading vs Demo Account vs Simulator

These terms are used interchangeably, but they all mean the same thing:

- Paper trading = Traditional term from stock markets (trades were written on paper)

- Demo account = Modern term used by trading platforms

- Crypto simulator = Another way to describe virtual trading

- Mock trading = Same concept (term used by Coinrithm)

- Virtual trading = Practice trading with fake money

All refer to practice trading with virtual funds.

Why Paper Trade Before Using Real Money

Most crypto beginners lose money in their first months. Here's why paper trading matters:

Zero financial risk – Learn without losing your savings

Test strategies – See what works before investing real capital

Master order types – Practice market orders, limit orders, stop-losses

Build confidence – Reduce emotional decision-making

Track performance – Understand your win rate and weaknesses

Experience volatility – Learn to handle 20%+ daily price swings

Develop discipline – Build consistent trading habits

The goal isn't to practice forever—it's to build competence so you don't blow up your account when switching to real money.

Common Paper Trading Mistakes to Avoid

Even with virtual money, traders make critical errors that hurt their learning:

Trading amounts you'd never risk – Practice with realistic position sizes

Ignoring risk management – Treat virtual money like real money

Chasing every trade – Quality over quantity

Not tracking results – Keep a journal of wins and losses

Skipping emotional awareness – Notice your reactions to gains and losses

Paper trading too long – Don't stay in practice mode for years

Best practice: Trade with the same discipline you'll use with real money.

How to Start Paper Trading Crypto (Step-by-Step)

Follow these steps to place your first Mock Trade quickly and confidently.

This section walks you through placing your first paper trade using Mock Trade, from account creation to tracking results.

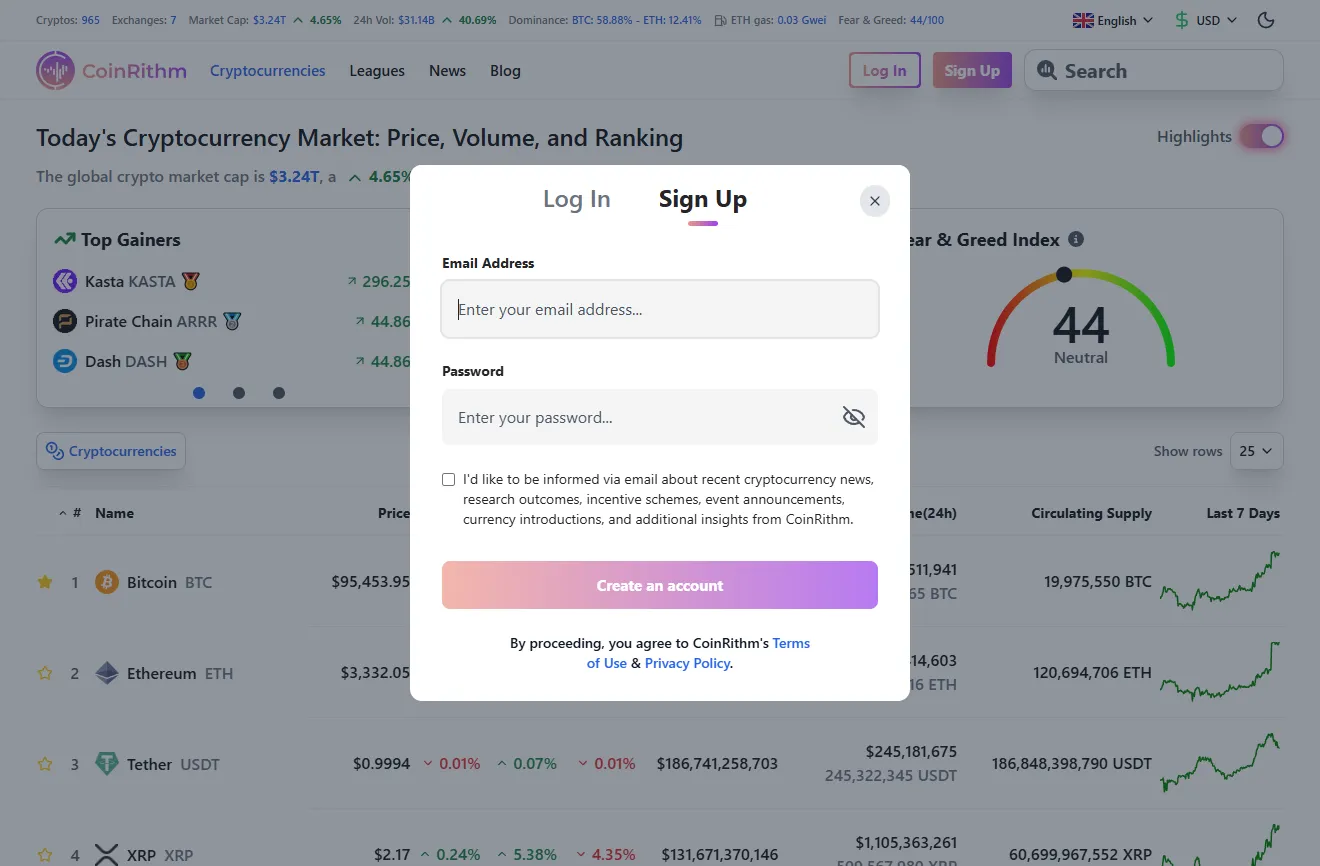

Step 1: Create Your Free Account

Time required: 60 seconds

- Visit Coinrithm

- Click "Sign Up" in the top right

- Enter your email and create a password

- Verify your email address

- You're in—no KYC required, no ID, no phone number, no credit card

Important: Coinrithm is 100% free for paper trading with no KYC verification. You'll never be asked to deposit real money to practice.

Figure: Coinrithm Sign-Up Screen.

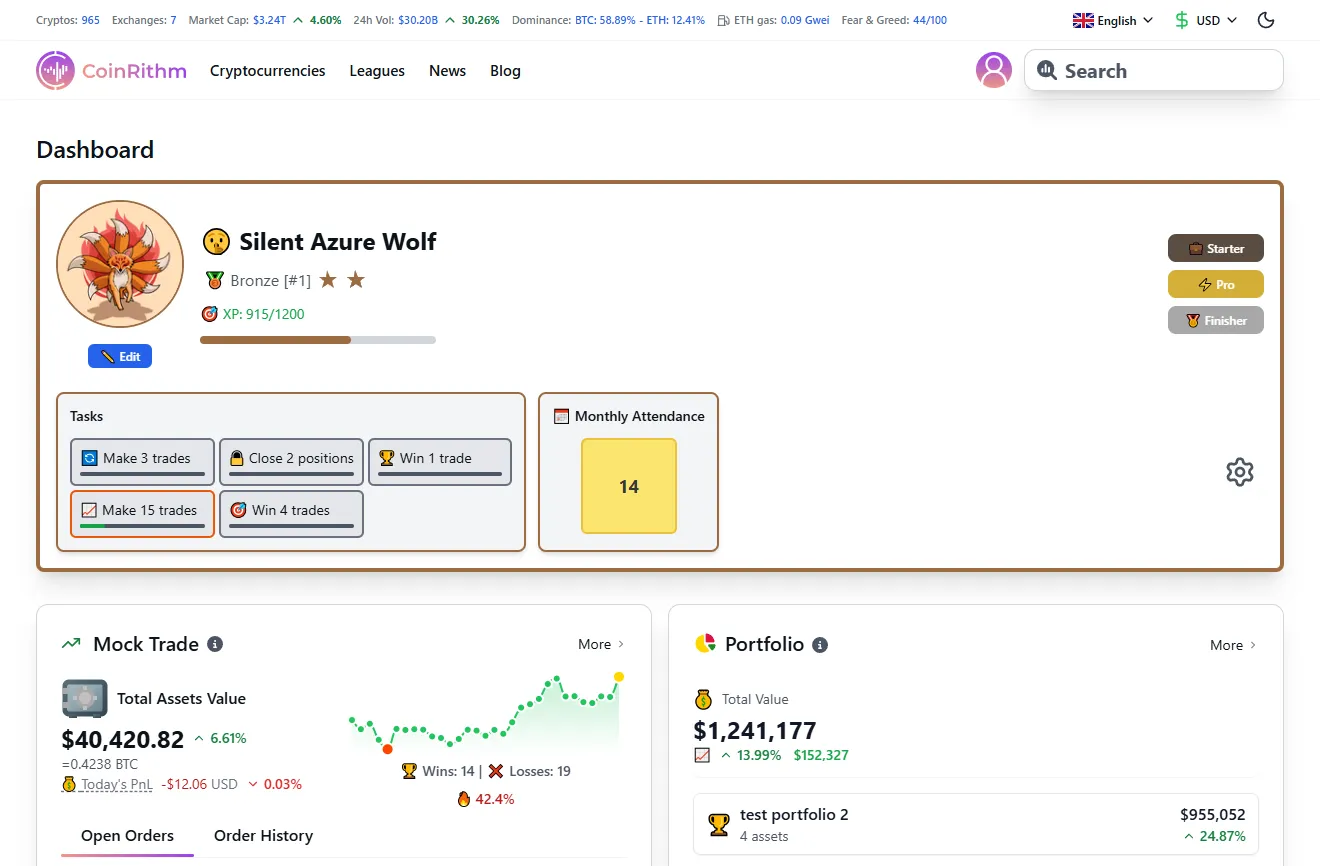

Step 2: Navigate to Mock Trade

Once logged in, you have two ways to start paper trading:

Option 1: From the Dashboard

- Navigate to your Dashboard

- You'll see your profile with your league rank (starts at Bronze), XP progress, and daily tasks

- Check the Mock Trade section showing your current virtual balance

- Click "Mock Trade" to view your full virtual wallet

Figure: Dashboard showing league rank, XP progress, tasks, and Mock Trade overview.

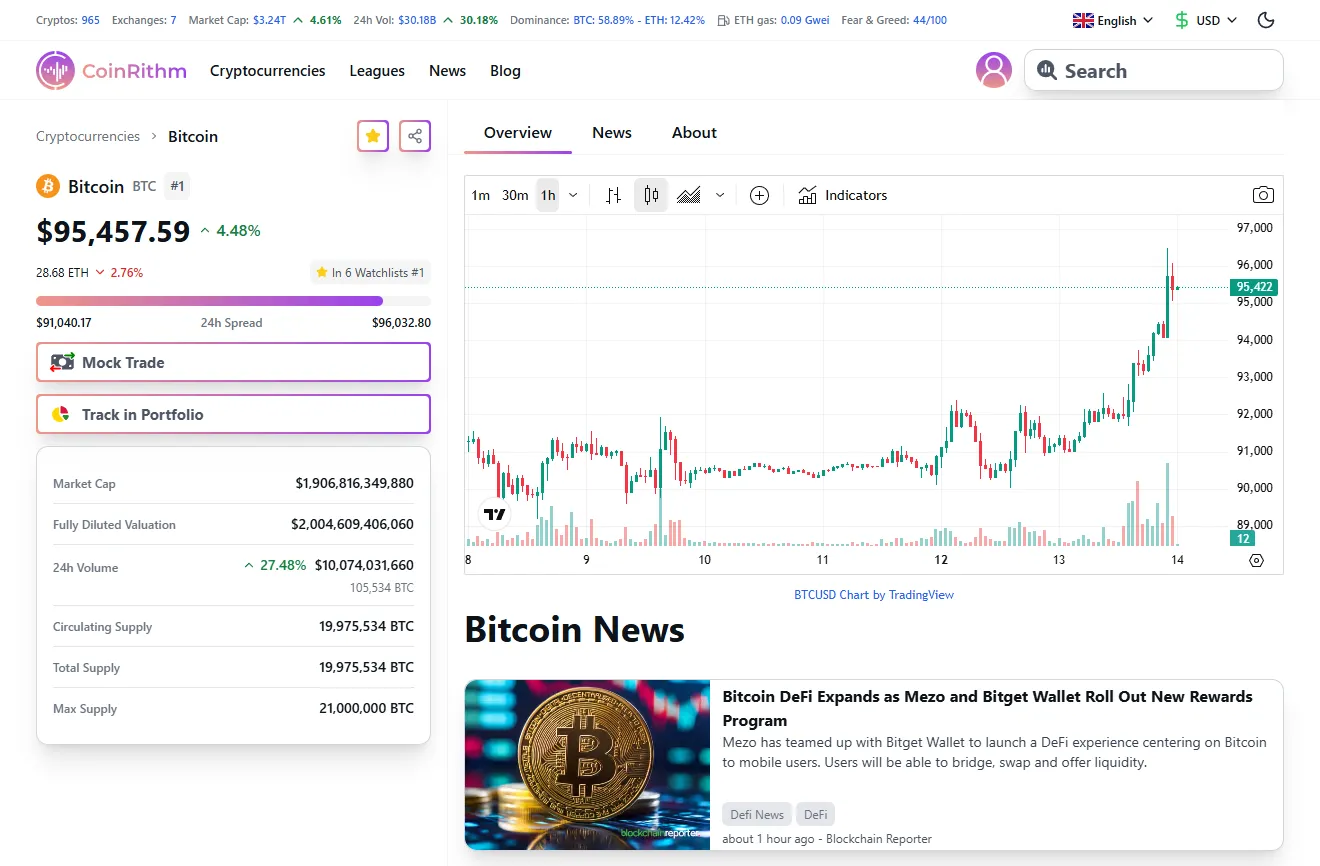

Option 2: From Any Coin Page

- Browse Cryptocurrencies or search for a specific coin

- Click on any coin (e.g., Bitcoin)

- On the coin page, you'll see two buttons:

- "Mock Trade" – Place a paper trade immediately

- "Track in Portfolio" – Add to your portfolio for tracking

- You can also add the coin to your Watchlist using the star icon

What you'll see on the coin page:

- Real-time price and 24h change

- Interactive TradingView price chart

- Market data (Market Cap, 24h Volume, Circulating Supply)

- Latest news from multiple sources

- Order interface (Buy/Sell with Limit, Market, Stop-Limit options)

Figure: Bitcoin coin page with Mock Trade and Track in Portfolio buttons.

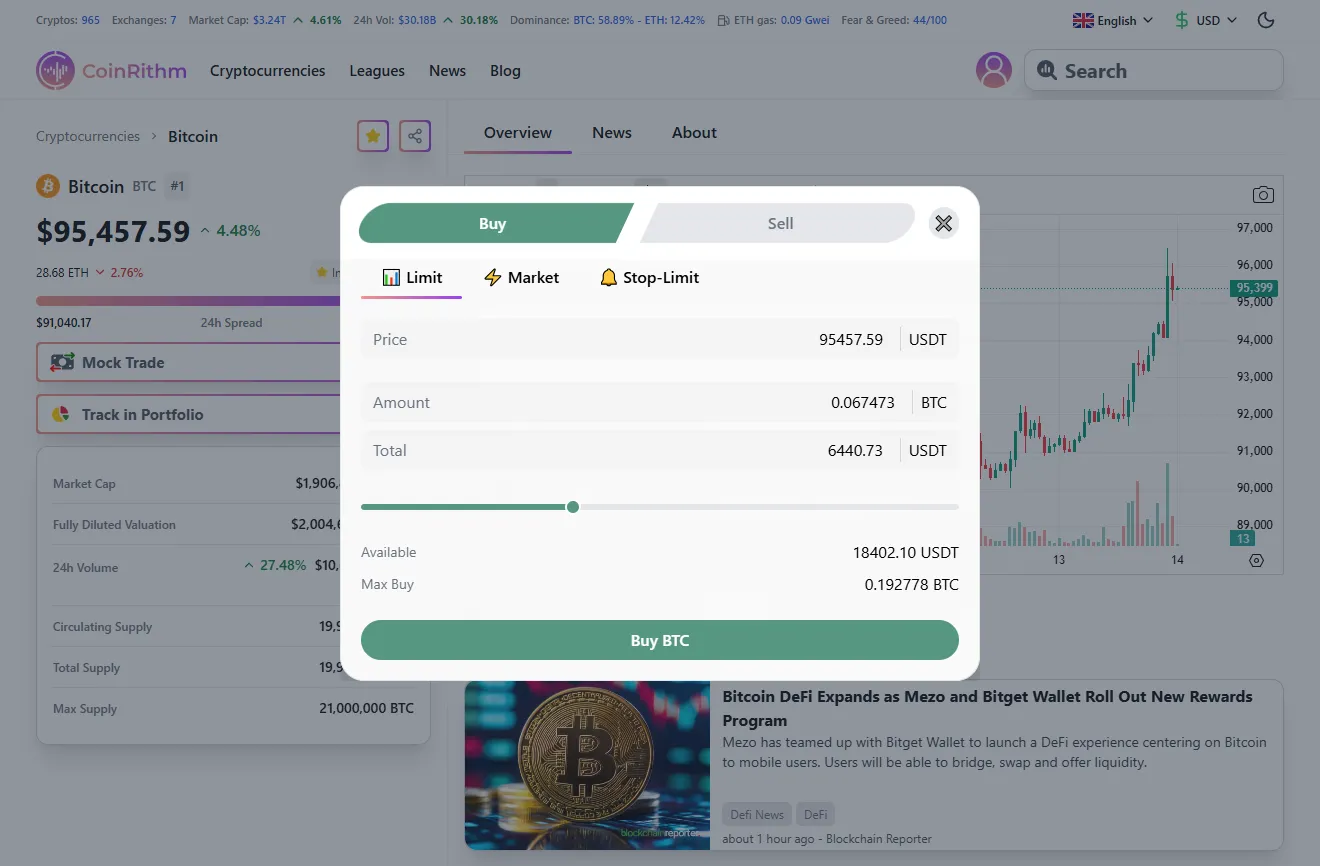

Step 3: Place Your First Mock Trade

To place a mock trade, select your coin, choose 'Market Order' for instant execution, and enter your virtual USDT amount.

Here's how to place your first paper trade using Bitcoin as an example:

Step-by-step:

-

Navigate to Bitcoin page – Search for Bitcoin or click it from the top cryptocurrencies list

-

Click "Mock Trade" – The button on the left sidebar opens the order interface

-

Choose Buy or Sell – Select the "Buy" tab (green) at the top of the order window

-

Select order type – Three options available:

- Limit Order – Set your own price (order fills only when market reaches your price)

- Market Order – Execute immediately at current price ← Start here for beginners

- Stop-Limit Order – Advanced order type for stop-loss protection

-

Enter your amount – For a Market order:

- Amount field: Enter how much BTC you want to buy (e.g., 0.01 BTC)

- The Total field automatically calculates cost in USDT

- You'll see your Available balance (starts at $50,000 USDT)

- Max Buy shows the maximum BTC you can purchase

-

Review and execute – Click "Buy BTC" button

What happens after your order:

- Success notification appears

- Your USDT balance decreases by the purchase amount

- Your BTC holdings appear in the Mock Trade holdings table

- The trade records in Order History with timestamp, price, and amount

- Your Total Assets Value updates in real-time

Figure: Bitcoin order interface showing Market buy order with Available balance and Max Buy.

Pro tip: Start with 2-5% of your virtual balance per trade ($1,000-$2,500 out of $50,000). This is a position size guideline; your risk per trade is set by your stop-loss distance (risk = position size x stop-loss %).

Ready to put this into practice Start your first Mock Trade on Coinrithm.

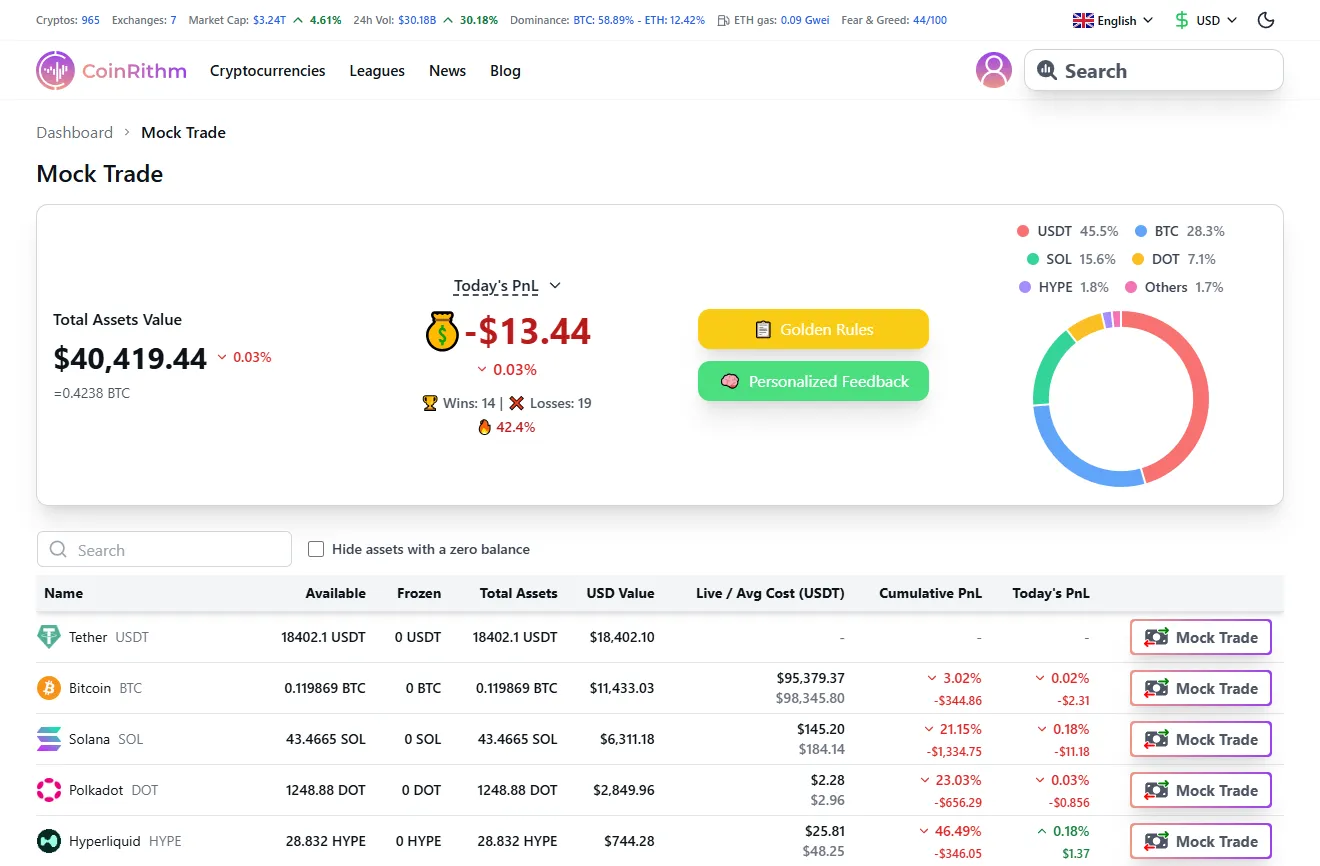

Step 4: Track Your Trade Performance

After placing your trade, navigate to the Mock Trade page to track everything:

Performance Overview (Top Section):

- Total Assets Value – Your entire virtual portfolio value (USDT + all crypto holdings)

- Today's PnL – Profit/loss for the current day with percentage change

- Wins & Losses – Count of profitable vs losing trades (e.g., "Wins: 14 | Losses: 17")

- Win Rate – Your success percentage (e.g., "45.2%")

Portfolio Allocation Chart:

Visual pie chart showing your holdings distribution by coin (e.g., BTC 47.0%, SOL 28.6%, USDT 14.6%, etc.)

Holdings Table:

Detailed view of each asset with columns:

- Name – Cryptocurrency with icon

- Available – Balance available for trading

- Frozen – Balance locked in open orders

- Total Assets – Total holdings of that coin

- USD Value – Current value in dollars

- Live / Avg Cost (USDT) – Current price vs your average purchase price

- Cumulative PnL – Total profit/loss for that coin with percentage

- Today's PnL – Today's profit/loss for that coin

Note: Your wallet base is USDT, while the UI may display USD-equivalent values for convenience.

Order Tracking:

- Open Orders tab – View active limit orders waiting to fill

- Order History tab – Complete history of all executed trades with buy/sell color coding, prices, amounts, and timestamps

Important Note: At the bottom of the page you'll see: "This doesn't represent any real money. It's for practice purposes only."

Your Mock Trade page updates in real-time as cryptocurrency prices change, giving you accurate practice data that mirrors live market conditions.

Figure: Mock Trade page showing portfolio overview, Today's PnL, holdings table, and performance metrics.

Step 5: Review AI Feedback

Coinrithm provides two types of AI-powered feedback to accelerate your learning:

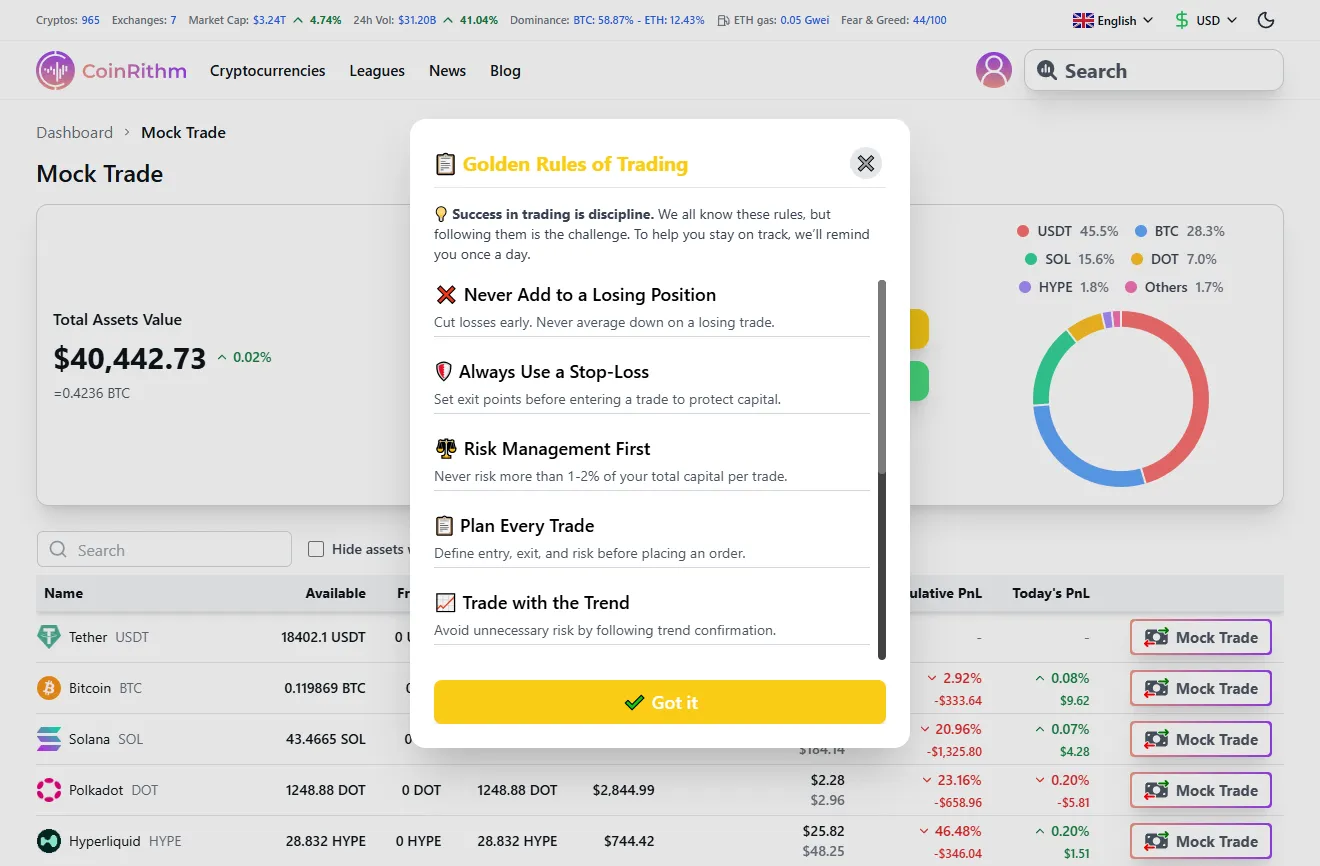

Golden Rules (Yellow Button):

Click the "Golden Rules" button to view 10 fundamental trading principles covering risk management, emotional discipline, and strategic planning. The modal appears once per day to reinforce best practices.

The 10 Golden Rules:

- Never Add to a Losing Position - Cut losses early. Never average down.

- Always Use a Stop-Loss - Set exit points before entering a trade.

- Risk Management First - Never risk more than 1-2% of capital per trade.

- Plan Every Trade - Define entry, exit, and risk before placing orders.

- Trade with the Trend - Follow trend confirmation to reduce risk.

- Keep Emotions in Check - Fear and greed lead to poor decisions.

- Diversify, but Don't Overdo It - Too many positions complicate risk management.

- Avoid Overtrading - Trade quality over quantity. Patience pays off.

- Learn from Mistakes - Review past trades to improve your strategy.

- Stay Updated on Market Conditions - News and events impact prices.

Important: The Golden Rules modal appears once per day to reinforce discipline without overwhelming you. Review these principles before placing trades to build best practices into your trading routine.

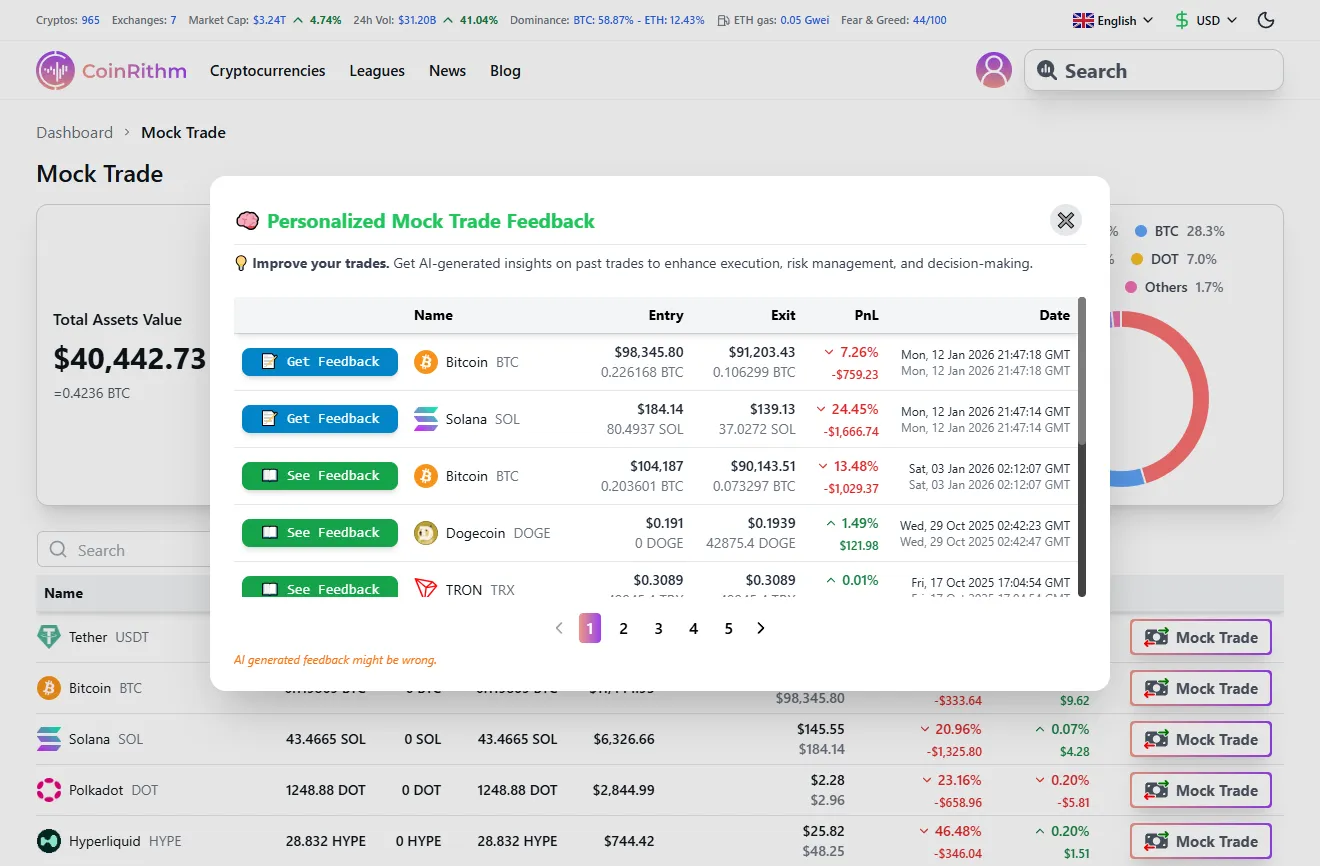

Personalized Mock Trade Feedback (Green Button):

Click the "Personalized Feedback" button to access AI analysis of your past trades:

What you'll see:

- Trade History Table with columns: Name, Entry (price + amount), Exit (price + amount), PnL (percentage + dollar), Date

- Each trade shows color-coded profit/loss (red for losses, green for gains)

- Two button states per trade:

- "Get Feedback" (blue) – Click to generate AI analysis for that specific trade

- "See Feedback" (green) – View previously generated feedback

How it works:

- Select a trade and click "Get Feedback"

- AI analyzes the trade (usually takes a couple of minutes)

- Come back later or wait for the analysis

- Click "See Feedback" to view AI insights on:

- Entry timing and execution quality

- Exit strategy effectiveness

- Risk management assessment

- Market conditions during the trade

- Suggestions for improvement

Note: At the bottom of the feedback window: "AI generated feedback might be wrong." – Use AI insights as learning tools, not absolute truth.

This dual feedback system helps you learn general principles (Golden Rules) while also getting specific analysis of your actual trading decisions (Personalized Feedback).

Figure: Golden Rules modal showing 10 trading principles with yellow header.

Figure: Personalized Feedback interface showing trade history with Get Feedback and See Feedback buttons.

Beginner First 7 Days Plan

A simple one-week routine to build habits without overwhelm.

Follow this simple routine to build discipline fast. Keep it light: one trade per day, one journal entry per day.

Day 1: Place one small market trade on a major coin, then log the entry, stop-loss, and reason.

Day 2: Place one limit order and write why you chose the price.

Day 3: Add a stop-loss and take-profit to your trade, then record the risk/reward.

Day 4: Practice position sizing (2-5% allocation) and note the exact risk in USDT.

Day 5: Try a different coin and record how volatility feels compared to BTC.

Day 6: Repeat your best setup from Days 1-5 and focus on clean execution.

Day 7 (Review Day): No trade. Review all journal entries, summarize 3 wins, 3 mistakes, and 1 rule to improve.

Understanding the Mock Trade Interface

A fast walkthrough of the balances, order types, and data you will use.

This section breaks down each element of the Mock Trade interface so you know exactly what you're looking at.

Virtual Balance and Starting Capital

Default starting balance: $50,000 USDT (virtual)

This amount is designed to:

- Mirror realistic trading capital for intermediate traders

- Allow multiple positions without over-leveraging

- Practice diversification across 5-10 different coins in your virtual wallet

- Test risk management with meaningful position sizes

How your balance changes:

- Decreases when you buy crypto with USDT

- Increases when you sell crypto back to USDT

- Stays constant while holding crypto (USDT balance is stable)

Example:

- Start: $50,000 USDT

- Buy $5,000 of BTC → Balance: $45,000 USDT + $5,000 BTC

- BTC increases 10% → Portfolio: $45,000 USDT + $5,500 BTC = $50,500 total

- Sell BTC → Balance: $50,500 USDT (you made $500 profit)

Order Types Explained

Coinrithm supports the essential order types you'll use in real trading:

Market Order

Executes immediately at the current market price.

Use when:

- You want to enter/exit a position right now

- Price precision isn't critical

- Market is moving fast and you need certainty

Example:

- BTC is $45,000

- You place a market buy for $1,000

- Order fills instantly at ~$45,000 (you get ~0.0222 BTC)

Limit Order

Executes only when price reaches your target.

Use when:

- You want to buy at a lower price than current market

- You want to sell at a higher price than current market

- You're patient and willing to wait for your price

Example:

- BTC is $45,000

- You place a limit buy at $44,000 for $1,000

- Order fills only if BTC drops to $44,000 or lower

Practice both order types to understand when each is appropriate.

Reading Real-Time Price Data

Every coin in Coinrithm shows:

- Current Price – Live price in USDT

- 24h Change – Percentage gain/loss in last 24 hours (green = up, red = down)

- 24h High/Low – Price range in last 24 hours

- Market Cap – Total value of all coins in circulation

- Volume – Total trading activity in last 24 hours

What to watch:

- High volume + price increase = Strong buying pressure (bullish)

- High volume + price decrease = Strong selling pressure (bearish)

- Low volume = Less certainty, wider spreads, more risk

Setting Stop-Loss and Take-Profit

Stop-Loss = Automatic sell order if price drops to your risk threshold Take-Profit = Automatic sell order if price hits your profit target

Why they matter:

- Protect your capital from large losses

- Lock in profits before reversals

- Remove emotion from exit decisions

- Critical risk management tools

Example Setup:

- Buy BTC at $45,000

- Set Stop-Loss at $43,000 (protect against 4.4% loss)

- Set Take-Profit at $47,500 (lock in 5.6% gain)

Practice using these orders in paper trading so they become second nature before using real money.

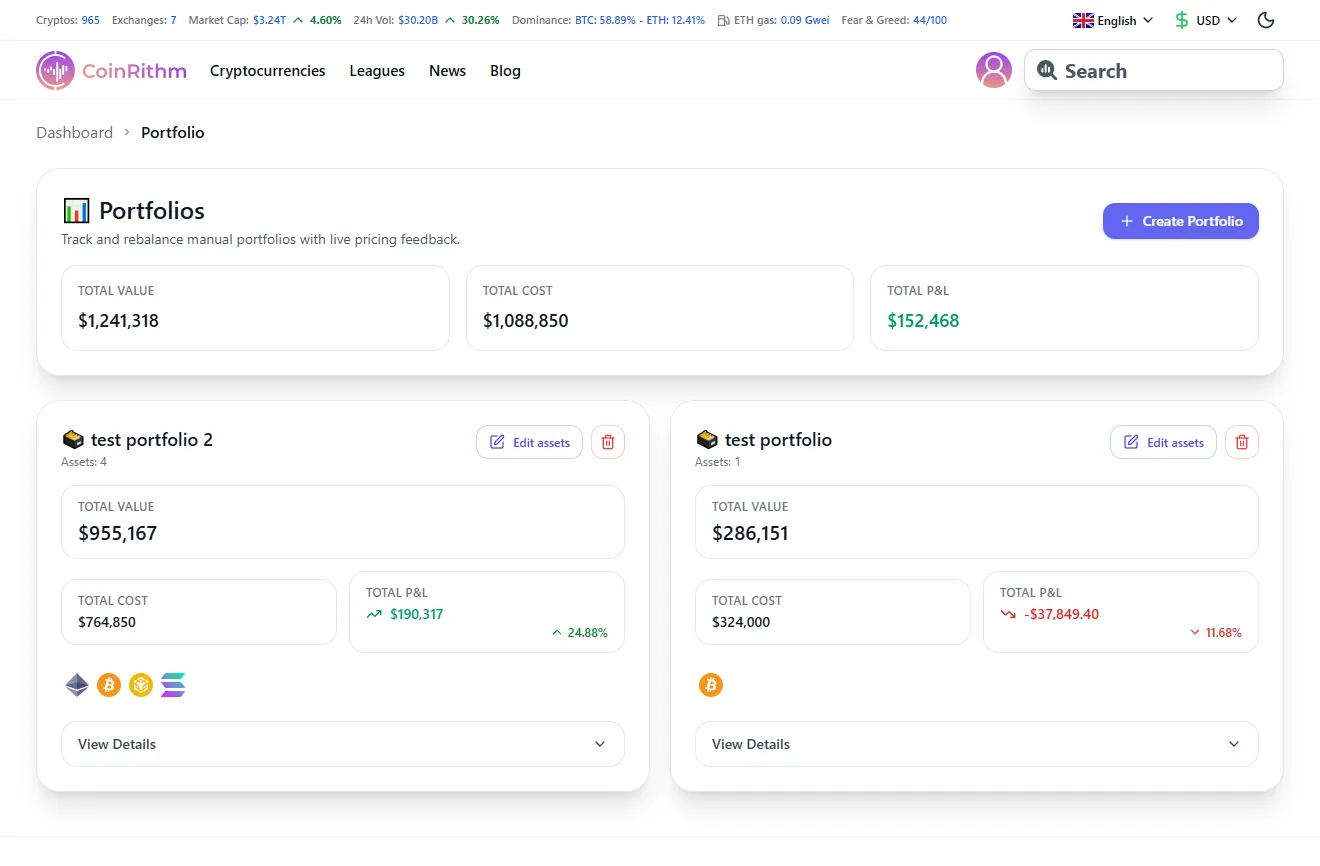

Complementary Features: Portfolio and Watchlist

How tracking tools support your learning alongside Mock Trade.

While Mock Trade is where you practice paper trading, Coinrithm offers two additional tools to support your learning:

Portfolio – Manually track cryptocurrencies you own on other exchanges (Binance, Coinbase, hardware wallets) or follow groups of coins you're interested in.

What you can do:

- Create multiple portfolios – Click "+ Create Portfolio" button to organize different holdings (e.g., "Binance Holdings", "Long-term Investments")

- Add coins from any coin page – Click "Track in Portfolio" button and select which portfolio to add it to

- View performance metrics – See Total Value, Total Cost, Total P&L for each portfolio

- Edit assets – Click "Edit assets" to update quantities, costs, or add/remove coins

- Delete portfolios – Only available from the Portfolio page (not from coin pages)

Portfolio overview shows:

- Cryptocurrency icons of holdings

- Individual portfolio performance with percentage gains/losses

- Detailed asset breakdown with Quantity, Avg Cost, Current Price, Value, and P&L when expanded

No API connections needed—fully secure manual tracking.

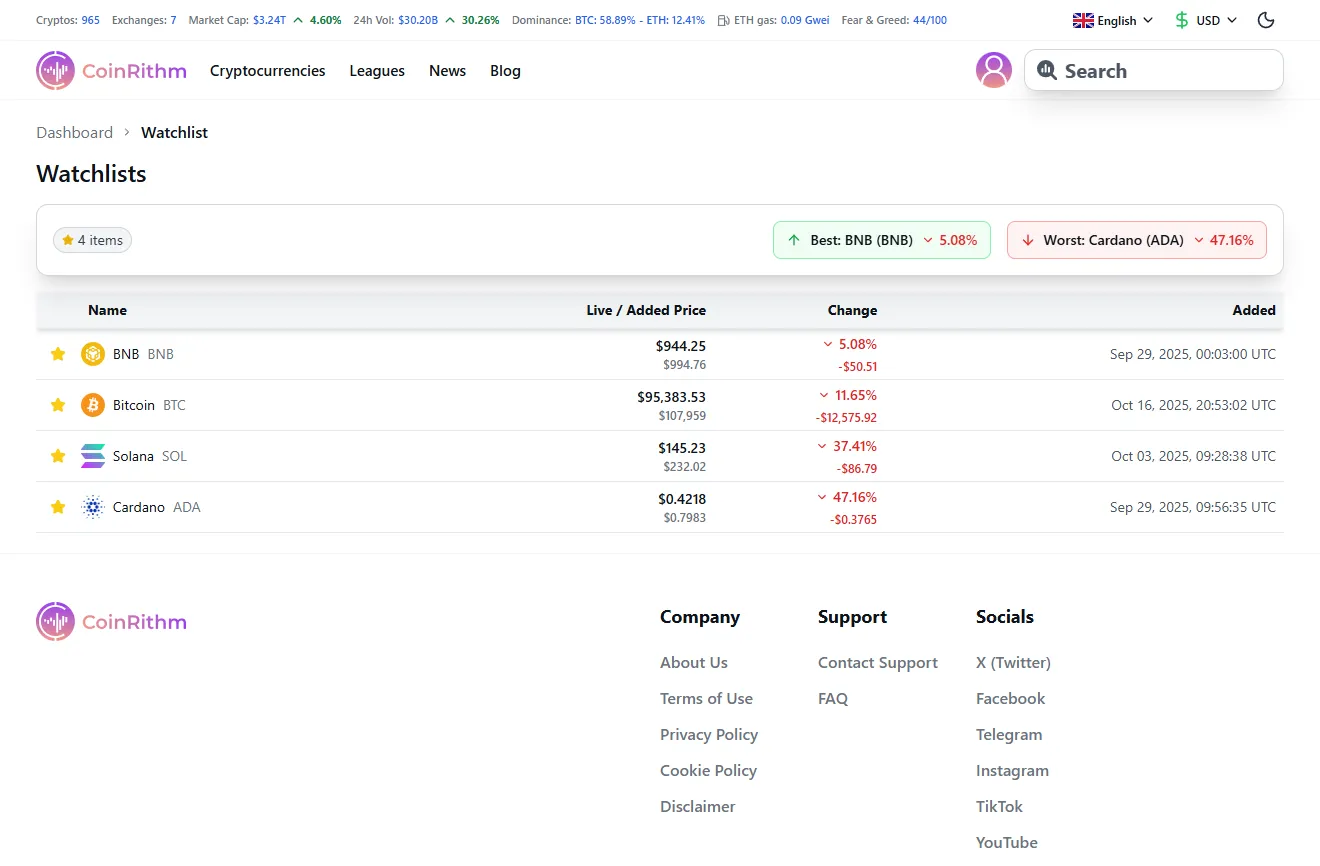

Watchlist – Monitor coins you're interested in before trading them. Track price changes since the moment you added each coin.

What you can do:

- Add coins from anywhere – Add from homepage coin table, coin pages, or directly in Watchlist using the star icon

- Track your entry point – See "Live / Added Price" showing current price vs price when you added it

- Monitor performance – View percentage and dollar change since you added each coin

- Quick insights – See "Best" and "Worst" performers at the top (e.g., "Best: BNB (BNB) ↑ 9.23%", "Worst: Cardano (ADA) ↓ 51.70%")

- Timestamp reference – Know exactly when you added each coin (e.g., "Oct 16, 2025, 20:53:02 UTC")

Important: Your paper trading performance is tracked in Mock Trade and Dashboard—Portfolio and Watchlist are separate tools for following markets and real holdings.

Figure: Portfolio page showing multiple portfolios with Total Value, Cost, and P&L metrics.

Figure: Watchlist showing coins with Live/Added Price comparison and performance since added.

Gamification: Leagues, Tasks, and Achievements

How progression systems keep you motivated and consistent.

Coinrithm uses gamification to keep you motivated and track your progress objectively. The league system and all gamification features are based on your paper trading performance in Mock Trade—this is where you prove your skills and advance through the ranks.

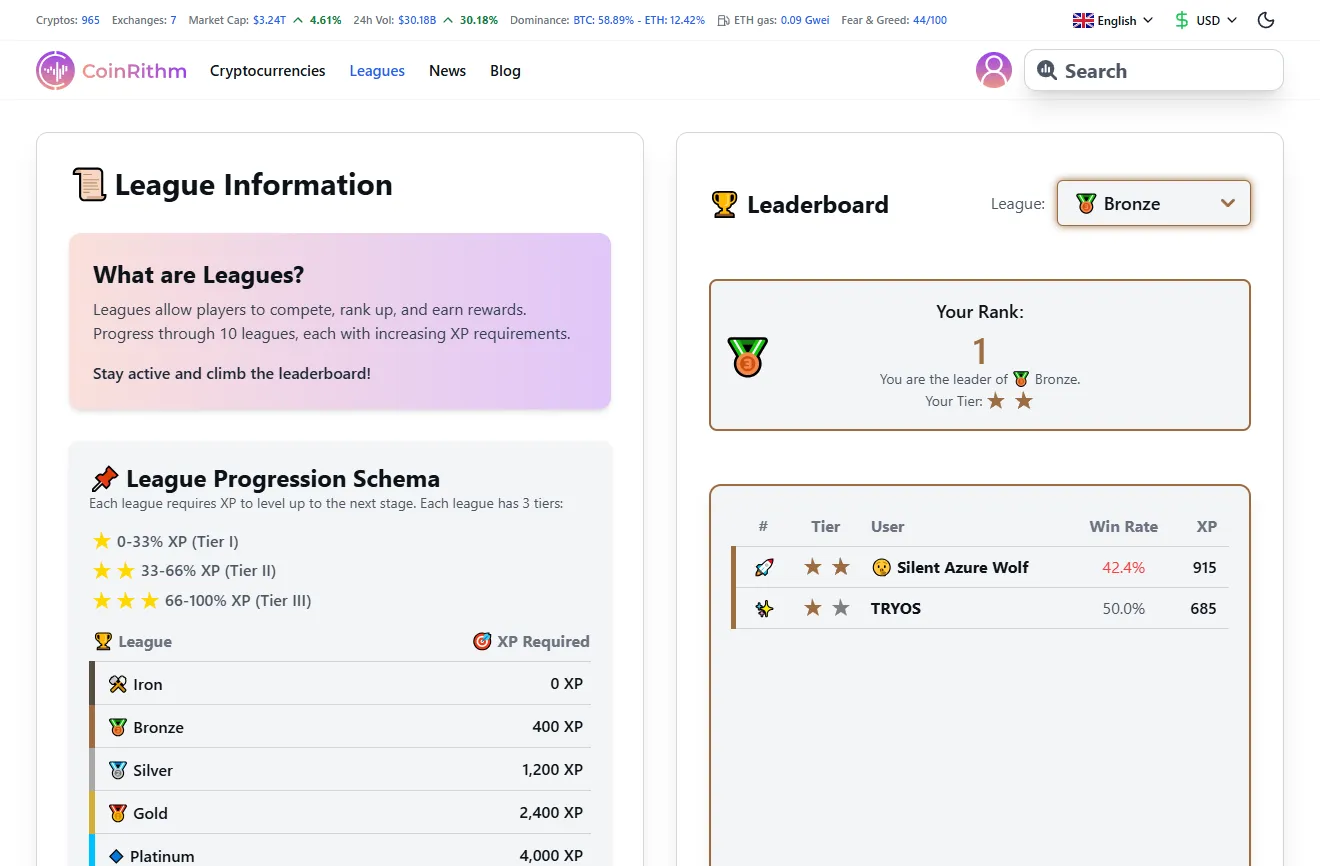

Understanding the League System

What are Leagues

Leagues allow players to compete, rank up, and earn rewards. Progress through 10 leagues, each with increasing XP requirements. Stay active and climb the leaderboard!

League Progression System:

Each league has 3 tiers based on your XP progress:

- Tier I: 0-33% XP

- Tier II: 33-66% XP

- Tier III: 66-100% XP

10 League Tiers (XP Required to Reach Each):

- Iron – 0 XP (Starting point)

- Bronze – 400 XP (Beginner progress)

- Silver – 1,200 XP (Developing skills)

- Gold – 2,400 XP (Consistent trader)

- Platinum – 4,000 XP (Advanced trader)

- Emerald – 6,000 XP (Skilled trader)

- Diamond – 8,600 XP (Expert level)

- Master – 12,600 XP (Top-tier trader)

- Grandmaster – 17,200 XP (Elite trader)

- Challenger – 24,500 XP (Ultimate rank)

Leaderboard Features:

- Your Rank – See your position within your current league (e.g., "#1 leader of Bronze")

- Your Tier – Visual tier indicator with stars showing Tier I, II, or III progress

- Top Performers – View other traders' usernames, win rates, and XP totals

- League Selection – Switch between leagues to see different leaderboards

Why it matters:

- Objective measurement of skill progression through XP milestones

- Motivation to stay active and climb the leaderboard

- Visual indicator of readiness for real trading (reaching higher leagues)

- Compete with other paper traders to improve your skills

Visual feature: Your league badge appears throughout the app, showing your current tier and rank.

Figure: League system showing 10 tiers from Iron to Challenger with XP requirements and leaderboard.

Daily Tasks and Challenges

Tasks are specific objectives that earn XP and help you build consistent trading habits.

Why tasks matter:

- Develop disciplined trading routines

- Learn risk management through practice

- Build consistency with daily/weekly objectives

- Earn XP to progress through leagues

- Track your skill development

Task focus areas:

✓ Executing trades – Practice different order types and strategies ✓ Risk management – Control position sizes and set stop-losses ✓ Consistency – Maintain regular trading activity and journaling

Strategy: Complete tasks daily to build habits that will serve you in real trading. Tasks are designed to reinforce the Golden Rules and develop your trading discipline.

Achievement Categories

Achievements unlock as you hit major milestones in your paper trading journey.

Why achievements matter:

- Visual recognition of your progress

- Clear milestones from beginner to advanced trader

- Badge colors match your league tier for unified progression

- Signal readiness for different trading strategies

- Motivate continuous improvement

Achievement progression:

Beginner milestones – First trades, basic risk management, portfolio diversification

Intermediate milestones – Consistent trading, profitable strategies, advanced order types

Advanced milestones – Long-term profitability, league advancement, mastery indicators

Visual feature: Achievement badges display in your league's colors, creating a cohesive progression experience throughout the app.

How to Earn XP and Level Up

XP (Experience Points) track your overall progress and power your league advancement.

How to earn XP:

✓ Complete daily and weekly tasks ✓ Unlock achievements at each milestone ✓ Trade consistently in Mock Trade ✓ Maintain trading streaks ✓ Review AI feedback on your trades

Progression benefits:

- Advance through 10 league tiers (Iron → Challenger)

- Move up within your league (Tier I → II → III)

- Increase leaderboard visibility

- Unlock achievement badges in your league colors

- Build measurable readiness for real trading

Strategy: Focus on completing tasks and building consistent habits rather than chasing XP numbers. Deliberate practice develops real trading skills—the XP progression tracks your improvement.

Trading Principles and AI Feedback

Core rules and AI insights that help you improve faster.

Coinrithm helps you learn through trading principles and AI-powered trade analysis.

Golden Rules

What it is: 10 fundamental trading principles to guide your decision-making.

Access: Click "Golden Rules" button (yellow) in the Mock Trade page.

Full list appears above: Jump to the Golden Rules list.

AI-Powered Trade Feedback

What it is: AI analysis of your specific trade decisions with detailed insights and actionable recommendations.

Access: Click "Personalized Feedback" button (green) in Mock Trade page, then click "Get Feedback" or "See Feedback" next to any completed trade.

What you'll see in the AI feedback modal:

1. Trade Summary Header:

- Trade type (BTC SELL/BUY) with key metrics

- Entry price → Exit price with P&L percentage and dollar amount

- Hold time (e.g., "Hold 0d 9h")

- Position size sold (e.g., "Sold 36.0% (0.1 BTC)")

Example:

BTC SELL • Entry $104,187.34 → Exit $90,143.51 • P&L -$1,029.37 (-13.5%) • Hold 0d 9h • Sold 36.0% (0.1 BTC)

2. Detailed Analysis Paragraph:

AI explains your decision-making and outcome in plain language:

Your exit at $90,143.51 after a 0d 9h hold from $104,187.34, selling 0.07 BTC (36.0% of the position), looks fear-driven rather than rule-based. Since exit, BTC moved to $91,307.16 (+1.3%), and the market showed a Golden Cross with RSI 52.2, suggesting you missed a potential bounce.

3. Market Analysis (Blue Box):

Technical insights about market conditions during your trade:

Technical insight: despite a Golden Cross and RSI 52.2, your exit at $90,143.51 came on a minor pullback (price just ~0.1% below SMA20) while the current price is 91,307.16, +1.3% from exit; adopt a rule to exit only after a clear close below SMA20 with RSI under 50.

4. 🥉 Your League Progress:

Shows your current rank, record, and win rate:

Bronze • 14W-17L • 45.2% win rate — steady improvement: your Sharpshooter badge is closer.

5. Next Trade Action Plan (Green Box):

Specific, actionable recommendations for your next trade:

Next trade action: limit size to 12% of wallet (≈$4,725) and re-enter only on a 1-hour close above $92,000 with RSI > 55; place a stop at entry minus 2% and target a 4% gain.

Important: At the bottom: "AI generated feedback might be wrong." – Use as learning guidance, not absolute rules.

Why it's valuable: Each trade becomes a learning opportunity with specific technical analysis, emotional pattern recognition, and concrete next steps to improve your strategy.

Learning from Mistakes

Common mistakes AI feedback identifies:

Overtrading – Too many trades in a short period Feedback: "You've placed 15 trades today. Consider focusing on quality setups rather than quantity."

Poor position sizing – Risking too much per trade Feedback: "This trade represents 25% of your portfolio. Limit individual positions to 5% for better risk management."

No stop-loss – Failing to protect capital Feedback: "You entered without a stop-loss. Set one now to limit potential losses to 3-5%."

Chasing pumps – Buying after sharp price increases Feedback: "BTC is up 15% in 2 hours. Entering after parabolic moves often results in losses. Wait for consolidation."

Emotional trading – Revenge trading after losses Feedback: "You've placed 3 trades in 10 minutes after a loss. Take a break and review your strategy."

Use this feedback to develop self-awareness and avoid repeating mistakes when you trade with real money.

Developing Your Paper Trading Strategy

Practical guidance to test styles, manage risk, and set goals.

Paper trading is where you discover what works for you personally.

Testing Different Trading Styles

Day Trading

- Time horizon: Minutes to hours

- Goal: Capture small price movements multiple times per day

- Requires: Constant monitoring, fast execution, high discipline

- Practice: Place 5-10 trades per day, close all positions by end of day

Swing Trading

- Time horizon: Days to weeks

- Goal: Capture medium-term trends

- Requires: Patience, trend analysis, position management

- Practice: Hold 3-7 positions for 3-10 days each

Position Trading (Long-term)

- Time horizon: Weeks to months

- Goal: Capture major trends and market cycles

- Requires: Fundamental research, patience, risk tolerance

- Practice: Buy and hold for 30+ days, focus on major coins

DCA (Dollar-Cost Averaging)

- Time horizon: Months to years

- Goal: Reduce timing risk through consistent buying

- Requires: Discipline, long-term mindset

- Practice: "Buy" $500 of BTC every week regardless of price

Test each style in paper trading to discover which matches your schedule, personality, and risk tolerance.

Testing Automated Strategies and Scalping

Crypto paper trading bot strategies – While Coinrithm focuses on manual trading, paper trading is the perfect environment to manually test bot logic and scalping strategies before coding them.

How to use paper trading for bot development:

- Test entry/exit rules – Manually execute your bot's logic to validate if conditions trigger correctly

- Simulate high-frequency patterns – Practice scalping (quick in-and-out trades) to see if your timing rules work

- Validate risk management – Ensure your automated position sizing and stop-loss logic prevents large losses

- Track edge cases – Discover market conditions where your strategy fails before automating

Scalping practice:

- 5-15 minute holds – Enter and exit positions quickly based on small price movements

- High volume coins – Stick to BTC, ETH, BNB for tighter spreads

- Smaller position sizes – Use 1-3% positions for rapid entries/exits

- Strict stop-losses – Exit immediately if price moves against you (0.5-1% stops)

Why paper trade your bot strategy first:

Even if you plan to automate trading later, manually executing your strategy in a paper trading environment reveals flaws in your logic, helps you refine entry/exit conditions, and ensures your risk management works before you risk real capital on automated execution.

Bottom line: Paper trading isn't just for manual traders—it's where algorithmic traders test and refine their bot logic risk-free.

Risk Management Rules

The 2% Rule Never risk more than 2% of your portfolio on a single trade.

Example:

- Portfolio: $50,000

- Max risk per trade: $1,000 (2%)

- If stop-loss is 5% away, position size = $20,000 max ($20,000 x 5% = $1,000). Wide stops require smaller size, so you'd usually reduce size or tighten the stop.

- If stop-loss is 2% away, position size would be $50,000 to risk $1,000, so a 5% position cap ($2,500) becomes the limiter and your actual risk is $50.

The 5% Position Rule Never allocate more than 5% of your portfolio to a single coin.

Example:

- Portfolio: $50,000

- Max per position: $2,500

- Allows 20 different positions for diversification

Position size and risk are different. Use the position cap to limit allocation, then use your stop-loss to keep total risk under 2%.

The 3:1 Reward/Risk Ratio Only take trades where potential reward is at least 3x potential risk.

Example:

- Entry: $45,000

- Stop-loss: $44,000 (risk = $1,000 or 2.2%)

- Take-profit: $48,000 (reward = $3,000 or 6.7%)

- Ratio: 3:1

Practice these rules in paper trading until they become automatic.

Journaling Your Trades

Keep a trading journal to track:

Before the Trade:

- Date and time

- Coin and entry price

- Reason for entry (setup, signal, strategy)

- Stop-loss and take-profit levels

- Position size and risk percentage

After the Trade:

- Exit price and exit reason

- Profit/loss in USDT and percentage

- What went right

- What went wrong

- Lessons learned

Example Journal Entry:

- Date: Jan 12, 2026

- Coin: BTC

- Entry: $45,000

- Exit: $47,200

- P&L: +$2,200 (+4.9%)

- Setup: Breakout above $44,800 resistance with high volume

- Stop-loss: $43,500

- What went right: Waited for volume confirmation, set proper stop-loss

- What to improve: Could have taken partial profits at $46,500

- Lesson: Trust the strategy, don't get greedy

Copy-paste journal template:

Date:

Coin:

Setup/Reason:

Entry Price:

Position Size (USDT):

Stop-Loss:

Take-Profit:

Risk (USDT and %):

Exit Price:

Result (P/L in USDT and %):

What Went Right:

What Went Wrong:

Lesson:

Review your journal weekly to identify patterns in wins and losses.

Setting Realistic Goals

Poor paper trading goals:

- "Make $1 million in a month"

- "Win every trade"

- "Double my account every week"

Realistic paper trading goals:

- Achieve 55%+ win rate over 50 trades

- Average 2:1 reward/risk ratio

- Maintain discipline (no emotional revenge trading)

- Complete 30 consecutive days of journaling

- Graduate to real trading within 3 months

Remember: The goal isn't to get rich in paper trading. It's to build skills and confidence for real trading.

When to Transition from Paper to Real Trading

Criteria and cautions to help you avoid moving too fast.

Don't rush this step. Most beginners move to real money too soon and lose.

5 Signs You're Ready

1. Consistent Profitability

- At least 3 consecutive profitable weeks

- Win rate above 50%

- Positive P&L over 50+ trades

2. Risk Management Discipline

- You never violate the 2% rule

- Every trade has a stop-loss

- You stick to your position sizing rules

3. Emotional Control

- You don't revenge trade after losses

- You don't overtrade after wins

- You can walk away when frustrated

4. Strategy Clarity

- You have a written trading plan

- You know exactly when to enter/exit

- You stick to your strategy consistently

5. Education Completion

- You understand order types

- You can read charts and volume

- You know when not to trade

If you can check all 5 boxes, you're ready to start with small real amounts.

If you can't check all 5, keep practicing. There's no rush.

Starting with Small Real Amounts

When you're ready for real trading:

- Start with money you can afford to lose (1-5% of savings max)

- Use the same risk management rules you practiced

- Start with 1/10th the position sizes you used in paper trading

- Expect emotional differences – real money feels different

Example Transition:

- Paper trading: $50,000 virtual, $2,500 positions

- Real trading: $500 real, $25 positions (same 5% rule)

As you prove consistency with real money, gradually increase position sizes—but never violate your risk rules.

Why Paper Trading Never Fully Replicates Real Trading

What transfers well:

Technical analysis skills

Order execution knowledge

Strategy logic and setup recognition

Chart reading ability

What doesn't transfer:

Emotional pressure – Fear and greed feel different with real money

Psychological discipline – Easier to follow rules with fake money

Real slippage – Paper trading may not perfectly simulate order fills

Account growth pressure – No real stakes in paper trading

Slippage and Liquidity (Paper vs Real)

Paper trading fills often assume ideal liquidity. In real markets, fast moves, thin order books, and large order sizes can cause partial fills or worse prices. Expect small differences between your planned entry/exit and the actual fill, especially on lower-volume coins.

The solution: Paper trade until profitable, then start small with real money to learn emotional control.

The Hybrid Approach

Best strategy once you start real trading:

Paper Trading (Ongoing):

- Test new strategies

- Practice with risky setups

- Try different trading styles

Real Trading (Cautiously):

- Execute proven strategies only

- Use conservative position sizes

- Build emotional discipline

If you use Coinrithm, you can keep practicing with Mock Trade while tracking real holdings from other exchanges in the Portfolio feature.

This hybrid approach lets you keep learning without risking capital on untested ideas.

Frequently Asked Questions (FAQ)

Quick answers to the most common beginner questions.

Is crypto paper trading free

Yes. Coinrithm is 100% free for paper trading. You get:

- $50,000 virtual USDT

- Unlimited Mock Trades

- Real-time price data for hundreds of coins

- Portfolio tracking

- AI feedback

- No credit card required, no hidden fees

How long should I paper trade before using real money

Minimum recommendation: 1-3 months or until you achieve:

3 consecutive profitable weeks

Win rate above 50%

Consistent risk management (never break your rules)

Emotional control (no revenge trading)

Clear written strategy

Don't rush. Build competence first. The crypto market will still be here when you're ready.

Can I reset my paper trading balance if I lose money

On Coinrithm: Contact support if you want to reset your balance.

But consider this: Losing your paper trading balance is valuable feedback. It shows:

- Your strategy isn't working yet

- Your risk management needs improvement

- You're not ready for real money

Better approach: Analyze what went wrong, adjust your strategy, and practice until you're consistently profitable.

Do paper trading results predict real trading results

Partially—but with important differences:

Skills that transfer:

- Technical analysis

- Strategy execution

- Chart reading

- Risk management calculations

Skills that don't transfer:

- Emotional control under real financial pressure

- Discipline when your savings are at risk

- Psychological resilience after real losses

Reality: If you're profitable in paper trading, you have the technical skills. Real trading tests your psychology.

What's the difference between paper trading and backtesting

Paper Trading:

- Live practice with current market data

- You manually place trades in real-time

- Forward-looking (happening now)

- Tests execution + strategy + psychology

Backtesting:

- Testing strategy on historical data

- Automated simulation of past prices

- Backward-looking (already happened)

- Tests strategy logic only

Both are useful:

- Backtest your strategy first (does it work historically)

- Paper trade it (can you execute in real-time)

- Use small real money (can you handle emotions)

Can I paper trade on mobile

Yes. Coinrithm is available on:

- iOS app (App Store)

- Android app (Google Play)

- Mobile web (works in any mobile browser)

All features—Mock Trade, portfolio tracking, watchlists, AI feedback—work seamlessly on mobile.

What cryptocurrencies can I paper trade

Coinrithm offers:

- Hundreds of cryptocurrencies

- Real-time price data

- Major pairs: Bitcoin, Ethereum, BNB, Solana

- Altcoins and emerging projects

Recommendation for beginners: Start with top 10 coins by market cap. Learn the fundamentals with Bitcoin and Ethereum before exploring altcoins.

Should I paper trade and real trade at the same time

Yes—once you're ready for real money, this is a smart approach:

The Hybrid Strategy:

- Paper trading – Test new strategies, risky ideas, experimental setups

- Real trading – Execute proven strategies with small amounts

Benefits:

Keep learning without risking capital

Build emotional discipline with real stakes

Test new ideas before committing real money

If you use Coinrithm, you can continue paper trading with Mock Trade while tracking real holdings from other exchanges in the Portfolio feature.

How realistic is crypto paper trading

Very realistic for technical skills:

- Real-time market data

- Actual cryptocurrency prices

- Order execution practice

- Managing multiple trading positions

Less realistic for psychology:

- No fear when it's fake money

- No greed pressure

- No emotional reactions to losses

Conclusion: Paper trading teaches technical skills. Real trading (starting small) teaches emotional control.

Can I practice futures or leverage trading

Coinrithm focuses on spot trading (buying and holding crypto without leverage).

For futures/leverage practice, consider:

- Binance Testnet (futures)

- Bybit Testnet (derivatives)

- BitMEX Testnet (advanced leverage)

Recommendation: Master spot trading in paper mode before attempting leverage. Leverage amplifies both gains and losses—extremely risky for beginners.

Conclusion: Start Paper Trading Today

A concise recap and the next action to take.

Learning crypto trading doesn't have to cost you thousands in losses.

Paper trading lets you practice strategies, test ideas, and build confidence with zero financial risk.

Here's what you now know:

- What crypto paper trading is and why it matters

- How to place your first Mock Trade step-by-step

- How to track your performance in Mock Trade and use watchlists effectively

- How gamification (leagues, tasks, achievements) accelerates learning

- How Golden Rules guide your decisions and AI feedback helps you improve

- When to transition from paper to real trading

A simple starting checklist:

- Create a free account and get your virtual balance

- Place a Mock Trade on a major coin

- Review Golden Rules and AI feedback

- Complete a daily task to build consistency

- Track progress through leagues (Iron → Challenger)

- Practice risk management before using real money

Remember:

- Most beginners lose money at first—paper trading prevents this

- Build competence for 1-3 months minimum

- Start real trading with small amounts only

- Use the hybrid approach (paper + real) for ongoing learning

Don't rush the process. The goal isn't to practice forever—it's to build skills so you don't blow up your account when you switch to real money.

Ready to start

Start Paper Trading on Coinrithm Now – Free, no credit card, $50,000 virtual USDT waiting.

Last Updated: January 12, 2026

Disclaimer: Paper trading uses virtual funds and carries no real-money risk. Real trading involves risk; only use money you can afford to lose. Past paper trading performance does not guarantee real trading results.